spokane wa sales tax calculator

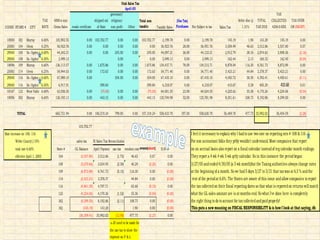

The County sales tax rate is. The December 2020 total local sales tax rate was 8900.

Washington State Sales Tax Rate Usgeocoder Blog

Interactive Tax Map Unlimited Use.

. The current total local sales tax rate in Spokane County WA is 8100. Real property tax on median home. The base sales tax in Washington is 65.

The December 2020 total local sales tax rate was also 8100. Sales Tax State Local Sales Tax on Food. To calculate sales and use tax only.

Washington State Spirits Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Spokane Valley Sales Tax is collected by the merchant on all qualifying sales made within Spokane Valley.

The 9 sales tax rate in Spokane consists of 65 Washington state sales tax and 25 Spokane tax. The current total local sales tax rate in Spokane WA is 9000. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. WA Sales Tax Rate. Counties cities and districts impose their own local taxes.

Real property tax on median home. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Spokane WA. US Sales Tax Washington Spokane Sales Tax calculator Airway Heights.

The Spokane Sales Tax is collected by the merchant on all qualifying sales made within Spokane. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on. The Spokane Valley Washington sales tax is 880 consisting of 650 Washington state sales tax and 230 Spokane Valley local sales taxesThe local sales tax consists of a 230 city sales tax.

The sales tax jurisdiction name is Not Downtown Spokane Tpa Sp which may refer to a local government divisionYou can print a 9 sales tax table hereFor tax rates in other cities see Washington sales taxes by city and county. You can see the total tax percentages of localities in the buttons. The results are rounded to two decimals.

This is the total of state county and city sales tax rates. Sales Tax State Local Sales Tax on Food. Search by address zip plus four or use the map to find the rate for a specific location.

The Spokane Washington sales tax is 880 consisting of 650 Washington state sales tax and 230 Spokane local sales taxesThe local sales tax consists of a 230 city sales tax. The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars. Look up a tax rate.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Special reporting instructions for sales or leases of motor vehicles RCW 8214450 4 provides an exemption from the public safety component of the retail sales tax approved by voters in a city or county. There is no applicable county tax or special tax.

Decimal degrees between -1250 and -116. The Washington sales tax rate is currently. Ad Lookup Sales Tax Rates For Free.

Calculator for Sales Tax in the Airway Heights. Tax rates can be looked up at the Department of Revenues tax website. Decimal degrees between 450 and 49005 Longitude.

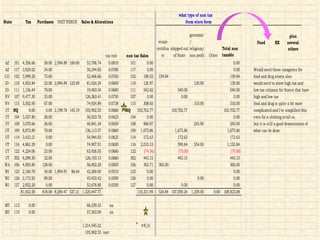

Spokane in Washington has a tax rate of 88 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Spokane totaling 23. Fill in price either with or without sales tax. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Use this search tool to look up sales tax rates for any location in Washington. You can find more tax rates and allowances for Spokane and Washington in the 2022 Washington Tax Tables.

To calculate sales and use tax only. There is base sales tax by Washington. US Sales Tax calculator Washington Spokane.

There are two taxes on spirits in Washington. Spokane County Sales Tax Rates PDF Spokane County Sales Tax Breakdown PDF Sales Tax Descriptions PDF Maps of Sales Tax Rates Sales tax ratelocation code for place of sale as defined by the Washington State Department of Revenue. The minimum combined 2022 sales tax rate for Spokane Washington is.

Groceries are exempt from the Spokane and Washington state sales taxes. Choose city or other locality from Spokane below for local Sales Tax calculation. The Spokane County Washington Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Spokane County Washington in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Spokane County Washington.

The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars. The motor vehicle saleslease tax also applies when use tax is due on demonstration executive and service vehicles.

Pin On Avoid Financial Scams Fraud

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Guide For Businesses

Sales Tax Examples Presentation

Washington Income Tax Calculator Smartasset

Washington Sales Tax Small Business Guide Truic

Washington Sales Tax Guide And Calculator 2022 Taxjar

States With Highest And Lowest Sales Tax Rates

Washington State Sales Tax Rate Usgeocoder Blog

Sales Tax Examples Presentation

Sales Tax Calculator For 98359 Olalla Washington United States In 2016 Heber City Heber The Unit

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt